6 min read

Client Memo - 2024Q1 - Complacency

The first quarter of 2024 provided yet another period of strong, seemingly risk-free gains, with the S&P 500 rising 10.6% for the quarter alongside...

4 min read

Michael Miller

:

Jul 27, 2024 8:39:06 PM

Michael Miller

:

Jul 27, 2024 8:39:06 PM

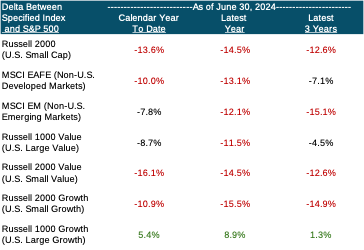

The first half of 2024 brought more of the same, as price and earnings momentum continue to drive gains for a small number of dominant businesses that vastly exceed those of virtually everything else across the broader market.

The red font highlights the many instances when the S&P 500 generated double-digit out-performance. Note that the figures in the three-year column are per year; when considered next to core indices that are increasingly and unusually concentrated, the idea that diversification provides a free lunch seems antiquated today, to put it mildly.

Where we are in terms of the cycle’s remaining duration and the degree to which it can become even more pronounced is anyone’s guess. What we do know is that times like these present investors with a set of difficult choices—choices that tend to have unusually large implications for future returns.

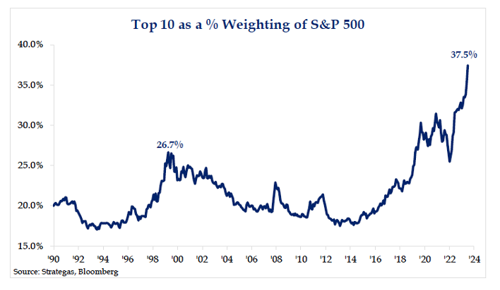

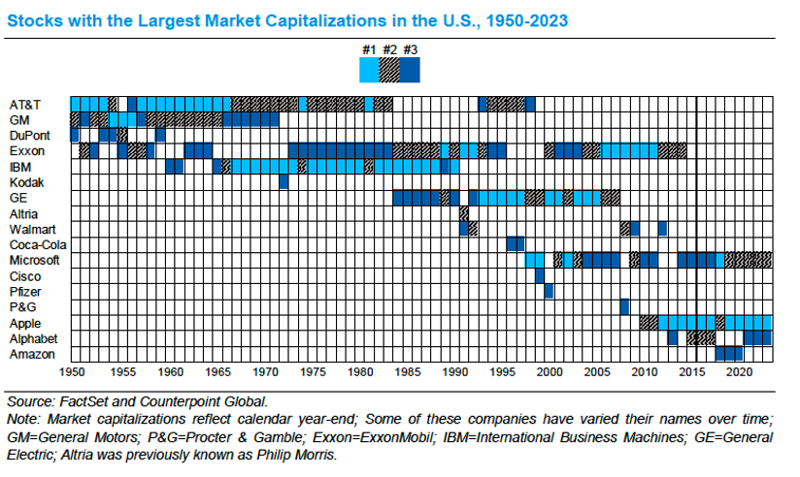

This can lead to unfortunate decisions as a cycle’s duration leads to ever-increasing pressure to conform and own more of the current favorites. Notably, while the popularity of many of the S&P 500’s largest names is easily justified, it appears to us that various, rather obvious risks are being ignored. Furthermore, little to no weight is being placed on the lessons of history as it relates to the dominant businesses of other eras, nor on the relative degree to which such names are compelling compared to the thousands of other choices available.

Instead, many investors are focused on both the outsized weighting and return contribution of these leading names[1], having in essence moved relative risk to the front of the line rather than maintaining focus on the absolute returns needed to support one’s long-term objectives. The idea that a trade-off exists is either outright rejected or simply ignored, as the concept appears to have no near-term value. Yet, this is the question we must all carefully consider; one’s views and actions from here could be of monumental importance. Fortunately, history does provide some guidance.

While the world and capital markets are always changing, human nature is largely a constant. As such, markets can be relied upon to set prices too optimistically for certain stocks around a good story, or too pessimistically when complexity arrives. In our view, today’s markets are particularly susceptible to this issue.

Valuation inevitably matters but can lie dormant for long periods. However, it can be relied upon to re-emerge unexpectedly to quickly introduce significant price changes. In other words, ignoring valuation seems harmless until it’s not, and it can exact a considerable and permanent toll when its time arrives for the unprepared.

But even though the above is difficult to refute, does it matter if the success dependent upon them requires a seemingly inhuman capacity for discipline and patience?

In a word, yes, as the nature of investing for a sustainable long-term return demands it. However, to start, we must embrace the fact that all investment strategies are subject to improvement; lessons can and should be learned during all periods. Those that become apparent during unusual periods are both exceptionally important and fraught with potential peril[2]. With that very much in mind, we plan to integrate two significant lessons into our thought process and advice moving forward:

While it's difficult in practice to separate out how much was due to stock selection versus these broader market trends, the truth is that the availability of mispriced stocks allows one to build a strong portfolio with more limited exposure tilts. While a combination of successful exposure tilts and strong security selection would have produced the best outcomes, the associated risks have been too outsized to tolerate relative to the short-term implications.

Yet, if the market’s pricing largely ignores anticipated changes or developments, a manager’s track record can become detached from the quality of their underwriting and replaced by its duration. For example, if a manager owns a company nearing a very successful shift in its business two years from now, it is quite likely that such a holding will drag down returns until that time.

Therefore, we’ll advise clients to be more careful about the degree to which allocations are made to longer-duration strategies, as too much capital directed in this manner is likely to struggle through intermediate periods.

Despite the challenges of the last few years, we remain resolutely confident in the value of diversification and the importance of retaining talented, differentiated investors. In that spirit, we believe the following to be notably important.

Despite the challenges associated with getting to this place, we’re glad to be here, as we can’t help but look at capitalization-weighted index valuations and wonder how such an investment could possibly support the return objectives of our clients. If history is any guide, it won’t, falling woefully short of the 10-15%+ returns of the many other securities that could be held instead.

And therein lies the problem at the heart of today’s short-term/long-term return dynamic.

There is of course nothing wrong with balancing these items if the true purpose of a capital pool is not violated. To this end, we’ve spent a great deal of time considering how our advice can be more successful in a market climate paradoxically the same as always while in many ways markedly different from the norm. A singular emphasis on long-term factors asks too much, although a driving focus on short-term outcomes would be far more dangerous in our opinion.

Ultimately, pretending that some investment choices do not involve a trade-off is a mistake that far too many appear to be making. A stronger approach is built from a more realistic foundation combined with a sure and steady evolution of one’s thinking.

[1] The S&P 500’s top ten names contributed 77% of its return for the first half of 2024.

[2] All too often, backwards-looking lessons serve one poorly when the investment climate shifts; that does not have to be the case and we have sought to avoid this mistake.

6 min read

The first quarter of 2024 provided yet another period of strong, seemingly risk-free gains, with the S&P 500 rising 10.6% for the quarter alongside...

7 min read

In a market environment marked by optimism, market concentration, and rising asset prices, non-profit institutional investors face critical...