US

row-spacer

row-spacer

EUROPE

According to data from Eurostat, economic growth across the Eurozone declined (-0.1% quarter over quarter) in the third quarter, as the region faced headwinds from inflation, rising interest rates, and tightened fiscal policies. Among the larger economies, France, Spain, and Belgium experienced growth while Germany contracted from persistent inflation, high energy prices, and weak foreign demand. Forward-looking economic indicators weakened for the region; the HCOB's final Composite PMI came in at 47.0. Manufacturing activity continued to contract and demand for services declined as consumers pulled back on spending. However, there was some signs of improvement in the manufacturing sub-indices tied to new orders and purchasing activity. Additionally, Eurozone unemployment remained at a record low of 6.4%; employment increased in both services and construction, offsetting weakness in the manufacturing sector. Overall, job vacancy rates have come down from their peaks but remain relatively high by historical standards.

After declining for much of the past year, the rate of inflation across the Eurozone rose to 2.9% in December. The uptick in inflation was primarily due to technical factors, as the impact of base effects and the timing of government subsidies overwhelmed slower price growth for other goods. (Note, core inflation, which doesn’t include energy, food, alcohol, and tobacco prices, ended the year at 3.4%, down from its 2022 peak.) In its last meeting of the year, the European Central Bank (ECB) reaffirmed its benchmark interest-rate policy and announced plans to phase out the last of its COVID-19 era bond-buying programs. The ECB also changed its language around inflation—from describing it as “expected to remain too high for too long,” to saying that it will “decline gradually over the course of next year.” In her statements following the meeting, ECB President Christine Lagarde assumed a more measured tone and argued against calls for imminent cuts to interest rates, stating that it’s too early to “lower our guard” and that the bank is “data dependent, not time dependent.”

CHINA

China’s economic data in Q4 2023 presented a mixed picture. Industrial output experienced a significant rebound, growing by 4.6% (year on year) in October and an impressive 6.6% in November. This growth—the fastest pace since February 2022—underscored the sector’s recovery and contribution to the economy. On the other hand, already affected by a downturn in the property sector, reduced land sale revenue, and a slowdown in export manufacturing, consumer spending was further impacted by household deleveraging. Credit cards and mortgage loans saw a decline, indicating caution among consumers. Overall spending remained below pre-COVID levels, suggesting a slow and gradual path towards recovery.

In response to the property market's challenges, the Chinese government rolled out several initiatives, including reducing down-payment thresholds and mortgage interest rates, and easing restrictions on second-home purchases. Such measures were designed to ease financial pressure on homebuyers and stimulate market activity. Another notable development was the provision of low-cost financing, amounting to CN¥1 trillion, for urban village renovations and affordable housing projects. This significant investment is intended to support the real-estate sector, a critical component of China's economy. Early indications suggest a positive reception from homebuyers, particularly in major cities, signaling a potential upturn in the real-estate market.

The November 2023 meeting between Chinese President Xi Jinping and US President Joe Biden was a landmark event. Key topics included curbing illicit fentanyl production and military cooperation, alongside a dialogue on artificial intelligence emphasizing the importance of managing risks and safety issues. Described as ‘constructive and productive,’ the meeting underlined both leaders' desire for peaceful coexistence and the necessity of avoiding miscommunication. While it did not resolve all critical geopolitical issues, the meeting was viewed as a positive step towards stabilizing US-China relations. The meeting's conciliatory tone and focus on cooperation in specific areas signaled a potential easing of the strained relations between the two nations.

JAPAN

Japan’s economy contracted at an annualized growth rate of 2.9% in the third quarter, as a decline in private consumption, which makes up more than half the economy, weighed on economic growth. Although nominal salaries rose year over year, higher prices and inflation wiped out the wage growth in real terms, negatively impacting consumers' purchasing power. In November, Prime Minister Fumio Kishida’s administration announced a new economic stimulus package (approximately $113 billion), aimed at helping households with rising costs. The packages included cuts to income and residential taxes, direct benefits to low earners, extended fuel and electricity subsidies, and funds to support the semiconductor sector.

Japanese business sentiment continued to improve during the quarter as measured by the Tankan survey. Results were especially strong among large manufactures; automakers' moods brightened as the industry benefited from a weak yen and an easing of supply constraints. Non-manufacturing sentiment was positive as well, improving for the seventh straight quarter; recovering inbound tourism gave a significant boost to non-manufacturers. Year to date through November, foreign visitors to Japan topped 20 million for the first time since 2019.

December data showed consumer core inflation trending downwards. Energy and fuel prices declined due to a combination of government subsidies and base effects. However, services inflation persists, driven primarily by demand for accommodations and food. The Bank of Japan (BOJ) ended the year with its low-interest polices in place. In his statement following the BOJ’s December meeting, Governor Kazuo Ueda cooled speculation about future rate hikes, stressing that more data is needed to confirm a positive wage-inflation cycle and the uncertainty surrounding inflation’s sustainability.

COMMODITIES

The S&P Goldman Sachs Commodity Index (SPGSCI) ended the quarter down with a total return of 10.73%, driven mainly by price gains for industrial metals and precious metals failing to offset weaker prices for energy, agriculture, and livestock. Contrary to Q3 2023, energy (16.74%; S&P GSCI Energy—SPGSEN) underperformed all other SPGSCI sub-index constituents, with sharply lower prices for crude oil, natural gas, and gas oil. These detractors to performance occurred despite output cuts from OPEC+. Agriculture (0.73%; S&P GSCI Agriculture—SPGSAG) ended the quarter with higher prices for soybeans, coffee, wheat, and cocoa failing to offset considerable price declines for sugar, corn, cotton, and Kansas wheat. The precious metals segment outperformed all other commodity constituents during the quarter (10.99%; S&P GSCI Precious Metals—SPGSPM), as both gold and silver achieved robust price gains during Q4 2023. The industrial metals segment realized a modest gain during the quarter (0.82%; S&P GSCI Industrial Metals—SPGSIM), as prices for aluminum, copper, and zinc offset weaker prices for nickel and lead.

Following a relatively quiet period in Q2/Q3 2023, the digital-assets market performed well during Q4. The premier digital token, Bitcoin, was up 57% in Q4 2023, while the second most-popular digital token, Ethereum (ETH), was up 37%, bringing the yearly returns to 155% and 91%, respectively. Speculation over the approval by the Securities and Exchange Commission (SEC) of a US spot Bitcoin exchange-traded fund (ETF) was a significant driver of price movements during the period; this was subsequently approved in January 2024.

US:

EUROPE:

According to data from Eurostat, economic growth across the Eurozone declined (-0.1% quarter over quarter) in the third quarter, as the region faced headwinds from inflation, rising interest rates, and tightened fiscal policies. Among the larger economies, France, Spain, and Belgium experienced growth while Germany contracted from persistent inflation, high energy prices, and weak foreign demand. Forward-looking economic indicators weakened for the region; the HCOB's final Composite PMI came in at 47.0. Manufacturing activity continued to contract and demand for services declined as consumers pulled back on spending. However, there was some signs of improvement in the manufacturing sub-indices tied to new orders and purchasing activity. Additionally, Eurozone unemployment remained at a record low of 6.4%; employment increased in both services and construction, offsetting weakness in the manufacturing sector. Overall, job vacancy rates have come down from their peaks but remain relatively high by historical standards.

After declining for much of the past year, the rate of inflation across the Eurozone rose to 2.9% in December. The uptick in inflation was primarily due to technical factors, as the impact of base effects and the timing of government subsidies overwhelmed slower price growth for other goods. (Note, core inflation, which doesn’t include energy, food, alcohol, and tobacco prices, ended the year at 3.4%, down from its 2022 peak.) In its last meeting of the year, the European Central Bank (ECB) reaffirmed its benchmark interest-rate policy and announced plans to phase out the last of its COVID-19 era bond-buying programs. The ECB also changed its language around inflation—from describing it as “expected to remain too high for too long,” to saying that it will “decline gradually over the course of next year.” In her statements following the meeting, ECB President Christine Lagarde assumed a more measured tone and argued against calls for imminent cuts to interest rates, stating that it’s too early to “lower our guard” and that the bank is “data dependent, not time dependent.”

CHINA:

China’s economic data in Q4 2023 presented a mixed picture. Industrial output experienced a significant rebound, growing by 4.6% (year on year) in October and an impressive 6.6% in November. This growth—the fastest pace since February 2022—underscored the sector’s recovery and contribution to the economy. On the other hand, already affected by a downturn in the property sector, reduced land sale revenue, and a slowdown in export manufacturing, consumer spending was further impacted by household deleveraging. Credit cards and mortgage loans saw a decline, indicating caution among consumers. Overall spending remained below pre-COVID levels, suggesting a slow and gradual path towards recovery.

In response to the property market's challenges, the Chinese government rolled out several initiatives, including reducing down-payment thresholds and mortgage interest rates, and easing restrictions on second-home purchases. Such measures were designed to ease financial pressure on homebuyers and stimulate market activity. Another notable development was the provision of low-cost financing, amounting to CN¥1 trillion, for urban village renovations and affordable housing projects. This significant investment is intended to support the real-estate sector, a critical component of China's economy. Early indications suggest a positive reception from homebuyers, particularly in major cities, signaling a potential upturn in the real-estate market.

The November 2023 meeting between Chinese President Xi Jinping and US President Joe Biden was a landmark event. Key topics included curbing illicit fentanyl production and military cooperation, alongside a dialogue on artificial intelligence emphasizing the importance of managing risks and safety issues. Described as ‘constructive and productive,’ the meeting underlined both leaders' desire for peaceful coexistence and the necessity of avoiding miscommunication. While it did not resolve all critical geopolitical issues, the meeting was viewed as a positive step towards stabilizing US-China relations. The meeting's conciliatory tone and focus on cooperation in specific areas signaled a potential easing of the strained relations between the two nations.

JAPAN:

Japan’s economy contracted at an annualized growth rate of 2.9% in the third quarter, as a decline in private consumption, which makes up more than half the economy, weighed on economic growth. Although nominal salaries rose year over year, higher prices and inflation wiped out the wage growth in real terms, negatively impacting consumers' purchasing power. In November, Prime Minister Fumio Kishida’s administration announced a new economic stimulus package (approximately $113 billion), aimed at helping households with rising costs. The packages included cuts to income and residential taxes, direct benefits to low earners, extended fuel and electricity subsidies, and funds to support the semiconductor sector.

Japanese business sentiment continued to improve during the quarter as measured by the Tankan survey. Results were especially strong among large manufactures; automakers' moods brightened as the industry benefited from a weak yen and an easing of supply constraints. Non-manufacturing sentiment was positive as well, improving for the seventh straight quarter; recovering inbound tourism gave a significant boost to non-manufacturers. Year to date through November, foreign visitors to Japan topped 20 million for the first time since 2019.

December data showed consumer core inflation trending downwards. Energy and fuel prices declined due to a combination of government subsidies and base effects. However, services inflation persists, driven primarily by demand for accommodations and food. The Bank of Japan (BOJ) ended the year with its low-interest polices in place. In his statement following the BOJ’s December meeting, Governor Kazuo Ueda cooled speculation about future rate hikes, stressing that more data is needed to confirm a positive wage-inflation cycle and the uncertainty surrounding inflation’s sustainability.

COMMODITIES:

The S&P Goldman Sachs Commodity Index (SPGSCI) ended the quarter down with a total return of 10.73%, driven mainly by price gains for industrial metals and precious metals failing to offset weaker prices for energy, agriculture, and livestock. Contrary to Q3 2023, energy (16.74%; S&P GSCI Energy—SPGSEN) underperformed all other SPGSCI sub-index constituents, with sharply lower prices for crude oil, natural gas, and gas oil. These detractors to performance occurred despite output cuts from OPEC+. Agriculture (0.73%; S&P GSCI Agriculture—SPGSAG) ended the quarter with higher prices for soybeans, coffee, wheat, and cocoa failing to offset considerable price declines for sugar, corn, cotton, and Kansas wheat. The precious metals segment outperformed all other commodity constituents during the quarter (10.99%; S&P GSCI Precious Metals—SPGSPM), as both gold and silver achieved robust price gains during Q4 2023. The industrial metals segment realized a modest gain during the quarter (0.82%; S&P GSCI Industrial Metals—SPGSIM), as prices for aluminum, copper, and zinc offset weaker prices for nickel and lead.

Following a relatively quiet period in Q2/Q3 2023, the digital-assets market performed well during Q4. The premier digital token, Bitcoin, was up 57% in Q4 2023, while the second most-popular digital token, Ethereum (ETH), was up 37%, bringing the yearly returns to 155% and 91%, respectively. Speculation over the approval by the Securities and Exchange Commission (SEC) of a US spot Bitcoin exchange-traded fund (ETF) was a significant driver of price movements during the period; this was subsequently approved in January 2024.

![UnderConstruction_shutterstock_415850113 [Converted]](https://www.crewcialpartners.com/hubfs/UnderConstruction_shutterstock_415850113%20%5BConverted%5D.png)

EUROPE

According to data from Eurostat, economic growth across the Eurozone declined (-0.1% quarter over quarter) in the third quarter, as the region faced headwinds from inflation, rising interest rates, and tightened fiscal policies. Among the larger economies, France, Spain, and Belgium experienced growth while Germany contracted from persistent inflation, high energy prices, and weak foreign demand. Forward-looking economic indicators weakened for the region; the HCOB's final Composite PMI came in at 47.0. Manufacturing activity continued to contract and demand for services declined as consumers pulled back on spending. However, there was some signs of improvement in the manufacturing sub-indices tied to new orders and purchasing activity. Additionally, Eurozone unemployment remained at a record low of 6.4%; employment increased in both services and construction, offsetting weakness in the manufacturing sector. Overall, job vacancy rates have come down from their peaks but remain relatively high by historical standards.

After declining for much of the past year, the rate of inflation across the Eurozone rose to 2.9% in December. The uptick in inflation was primarily due to technical factors, as the impact of base effects and the timing of government subsidies overwhelmed slower price growth for other goods. (Note, core inflation, which doesn’t include energy, food, alcohol, and tobacco prices, ended the year at 3.4%, down from its 2022 peak.) In its last meeting of the year, the European Central Bank (ECB) reaffirmed its benchmark interest-rate policy and announced plans to phase out the last of its COVID-19 era bond-buying programs. The ECB also changed its language around inflation—from describing it as “expected to remain too high for too long,” to saying that it will “decline gradually over the course of next year.” In her statements following the meeting, ECB President Christine Lagarde assumed a more measured tone and argued against calls for imminent cuts to interest rates, stating that it’s too early to “lower our guard” and that the bank is “data dependent, not time dependent.”

![UnderConstruction_shutterstock_415850113 [Converted]](https://www.crewcialpartners.com/hubfs/UnderConstruction_shutterstock_415850113%20%5BConverted%5D.png)

CHINA

China’s economic data in Q4 2023 presented a mixed picture. Industrial output experienced a significant rebound, growing by 4.6% (year on year) in October and an impressive 6.6% in November. This growth—the fastest pace since February 2022—underscored the sector’s recovery and contribution to the economy. On the other hand, already affected by a downturn in the property sector, reduced land sale revenue, and a slowdown in export manufacturing, consumer spending was further impacted by household deleveraging. Credit cards and mortgage loans saw a decline, indicating caution among consumers. Overall spending remained below pre-COVID levels, suggesting a slow and gradual path towards recovery.

In response to the property market's challenges, the Chinese government rolled out several initiatives, including reducing down-payment thresholds and mortgage interest rates, and easing restrictions on second-home purchases. Such measures were designed to ease financial pressure on homebuyers and stimulate market activity. Another notable development was the provision of low-cost financing, amounting to CN¥1 trillion, for urban village renovations and affordable housing projects. This significant investment is intended to support the real-estate sector, a critical component of China's economy. Early indications suggest a positive reception from homebuyers, particularly in major cities, signaling a potential upturn in the real-estate market.

The November 2023 meeting between Chinese President Xi Jinping and US President Joe Biden was a landmark event. Key topics included curbing illicit fentanyl production and military cooperation, alongside a dialogue on artificial intelligence emphasizing the importance of managing risks and safety issues. Described as ‘constructive and productive,’ the meeting underlined both leaders' desire for peaceful coexistence and the necessity of avoiding miscommunication. While it did not resolve all critical geopolitical issues, the meeting was viewed as a positive step towards stabilizing US-China relations. The meeting's conciliatory tone and focus on cooperation in specific areas signaled a potential easing of the strained relations between the two nations.

![UnderConstruction_shutterstock_415850113 [Converted]](https://www.crewcialpartners.com/hubfs/UnderConstruction_shutterstock_415850113%20%5BConverted%5D.png)

JAPAN

Japan’s economy contracted at an annualized growth rate of 2.9% in the third quarter, as a decline in private consumption, which makes up more than half the economy, weighed on economic growth. Although nominal salaries rose year over year, higher prices and inflation wiped out the wage growth in real terms, negatively impacting consumers' purchasing power. In November, Prime Minister Fumio Kishida’s administration announced a new economic stimulus package (approximately $113 billion), aimed at helping households with rising costs. The packages included cuts to income and residential taxes, direct benefits to low earners, extended fuel and electricity subsidies, and funds to support the semiconductor sector.

Japanese business sentiment continued to improve during the quarter as measured by the Tankan survey. Results were especially strong among large manufactures; automakers' moods brightened as the industry benefited from a weak yen and an easing of supply constraints. Non-manufacturing sentiment was positive as well, improving for the seventh straight quarter; recovering inbound tourism gave a significant boost to non-manufacturers. Year to date through November, foreign visitors to Japan topped 20 million for the first time since 2019.

December data showed consumer core inflation trending downwards. Energy and fuel prices declined due to a combination of government subsidies and base effects. However, services inflation persists, driven primarily by demand for accommodations and food. The Bank of Japan (BOJ) ended the year with its low-interest polices in place. In his statement following the BOJ’s December meeting, Governor Kazuo Ueda cooled speculation about future rate hikes, stressing that more data is needed to confirm a positive wage-inflation cycle and the uncertainty surrounding inflation’s sustainability.

![UnderConstruction_shutterstock_415850113 [Converted]](https://www.crewcialpartners.com/hubfs/UnderConstruction_shutterstock_415850113%20%5BConverted%5D.png)

COMMODITIES

The S&P Goldman Sachs Commodity Index (SPGSCI) ended the quarter down with a total return of 10.73%, driven mainly by price gains for industrial metals and precious metals failing to offset weaker prices for energy, agriculture, and livestock. Contrary to Q3 2023, energy (16.74%; S&P GSCI Energy—SPGSEN) underperformed all other SPGSCI sub-index constituents, with sharply lower prices for crude oil, natural gas, and gas oil. These detractors to performance occurred despite output cuts from OPEC+. Agriculture (0.73%; S&P GSCI Agriculture—SPGSAG) ended the quarter with higher prices for soybeans, coffee, wheat, and cocoa failing to offset considerable price declines for sugar, corn, cotton, and Kansas wheat. The precious metals segment outperformed all other commodity constituents during the quarter (10.99%; S&P GSCI Precious Metals—SPGSPM), as both gold and silver achieved robust price gains during Q4 2023. The industrial metals segment realized a modest gain during the quarter (0.82%; S&P GSCI Industrial Metals—SPGSIM), as prices for aluminum, copper, and zinc offset weaker prices for nickel and lead.

Following a relatively quiet period in Q2/Q3 2023, the digital-assets market performed well during Q4. The premier digital token, Bitcoin, was up 57% in Q4 2023, while the second most-popular digital token, Ethereum (ETH), was up 37%, bringing the yearly returns to 155% and 91%, respectively. Speculation over the approval by the Securities and Exchange Commission (SEC) of a US spot Bitcoin exchange-traded fund (ETF) was a significant driver of price movements during the period; this was subsequently approved in January 2024.

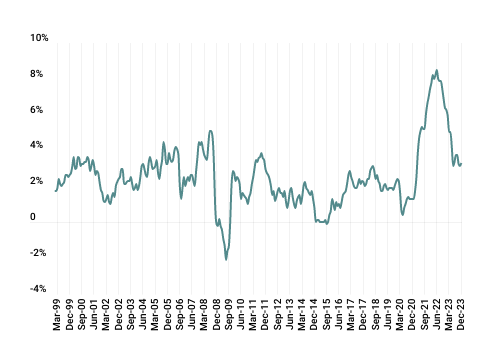

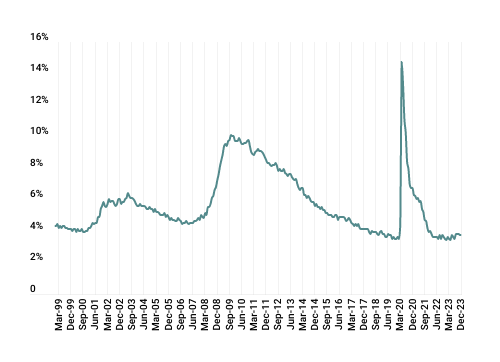

ROLLING 12-MONTH CONSUMER PRICE INDEX

25 YEARS THROUGH DECEMBER 2023

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.3% in December, following a 0.1% increase in November. The all-items index rose 3.4% before seasonal adjustment over the previous twelve months. Over the past twelve months, the major contributors include transportation services, up 9.7% (driven by motor-vehicle insurance, up 20.3%), tobacco and smoking products, up 7.8%, and shelter, up 6.2%.

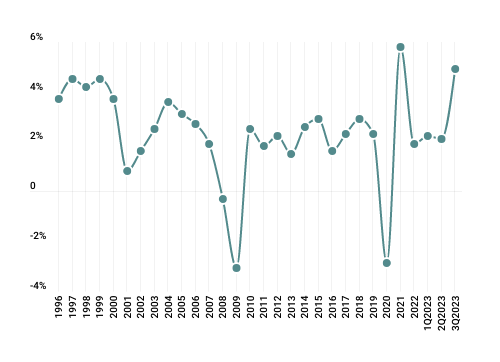

REAL GROSS DOMESTIC PRODUCT

25 YEARS THROUGH 3Q2023

During Q3 2023, real GDP rose at an annual rate of 4.9% followed by a 2.1% increase in Q2 2023. The increase was driven by consumer spending and inventory investment; imports also increased. Overall, 14 of 22 industry groups contributed to real GDP growth in the third quarter; the value added from private goods-producing industries was particularly strong at 10.2%.

RETAIL SALES

Total retail and food sales increased 0.3% and 4.1% month-to-date and year-to-date ending November 2023, respectively. Total sales from September through November 2023 were up 3.4% compared to the same period one year ago; the percentage change over the same period was up 0.4%. Significant contributors include non-store retailers and food services and drinking places.

Unemployment RATE

25 YEARS THROUGH DECEMBER 2023

A total of 494,000 jobs were created in the fourth quarter of 2023, which did not outpace the previous quarter’s gains of 710,000. The US economy added 216,000 jobs in November, which is below the twelve-month average monthly gain of 225,000. December’s notable job gains occurred within the following industries: government (+52,000), health care (+38,000), social assistance (+21,000), and construction (+17,000).

The unemployment rate remains unchanged from the previous quarter’s average at 3.7%. The number of unemployed persons (6.3 million) experienced minimal net movement as well. The labor force participation rate decreased by 0.3% in December (62.5%).

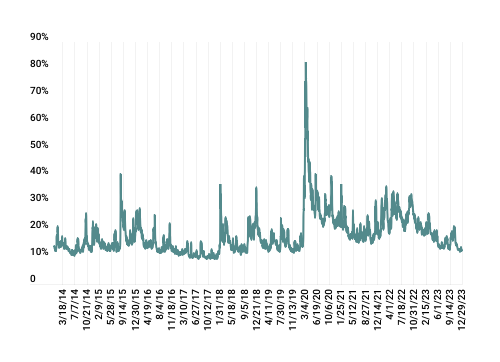

CBOE VIX DAILY CLOSING VALUES

LAST 10 YEARS

During Q2 2023, real GDP rose at an annual rate of 2.1%, following a 2.2% increase in Q1. The increase was driven by state and local government spending, non-residential fixed investment, and consumer spending, partially offset by a decrease in exports; imports also decreased. Relative to Q1, the second quarter experienced a slowdown in consumer and federal government spending alongside the decline in exports, which drove the Q2 deceleration of real GDP.

CPI

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.3% in December, following a 0.1% increase in November. The all-items index rose 3.4% before seasonal adjustment over the previous twelve months. Over the past twelve months, the major contributors include transportation services, up 9.7% (driven by motor-vehicle insurance, up 20.3%), tobacco and smoking products, up 7.8%, and shelter, up 6.2%.

GDP

During Q3 2023, real GDP rose at an annual rate of 4.9% followed by a 2.1% increase in Q2 2023. The increase was driven by consumer spending and inventory investment; imports also increased. Overall, 14 of 22 industry groups contributed to real GDP growth in the third quarter; the value added from private goods-producing industries was particularly strong at 10.2%.

Retail Sales

Total retail and food sales increased 0.3% and 4.1% month-to-date and year-to-date ending November 2023, respectively. Total sales from September through November 2023 were up 3.4% compared to the same period one year ago; the percentage change over the same period was up 0.4%. Significant contributors include non-store retailers and food services and drinking places.

Unemployment

VIX

Market volatility, as measured by the VIX Index, had an average close in Q4 2023 at 15.29, trending up from Q3 (15.01) and down from Q2 (16.48). The index has dropped below its five-year average of 20.58, reflecting positive investor sentiment and a high level of comfort with the overall direction of the economy.

GMS Table Templates

| Q4 2023 | YTD | Q4 2023 |

YTD

|

||

|

Title

|

0%

|

0%

|

Title

|

0%

|

0%

|

|

Title

|

0%

|

0%

|

Title

|

0%

|

0%

|

|

Title

|

0%

|

0%

|

Title

|

0%

|

0%

|

| Q4 2023 | YTD | Q4 2023 |

YTD

|

||

|

Large Cap Value

|

0%

|

0%

|

Large Cap Growth

|

0%

|

0%

|

|

Mid Cap Value

|

0%

|

0%

|

Mid Cap Growth

|

0%

|

0%

|

|

Small Cap Value

|

0%

|

0%

|

Small Cap Growth

|

0%

|

0%

|

| U.S. Large Cap | U.S. Mid Cap | U.S. Small Cap | ||||

| Q4 2023 | YTD | Q4 2023 | YTD | Q4 2023 |

YTD

|

|

|

Title

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Title

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Title

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Title

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Title

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Title

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Title

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Title

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Title

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Title

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Title

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Title

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Title

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

| Header | Header | |||

| Header | Q4 2023 | YTD | Q4 2023 | YTD |

|

Title1

|

0%

|

0%

|

0%

|

0%

|

|

Title2

|

0%

|

0%

|

0%

|

0%

|

|

Title3

|

0%

|

0%

|

0%

|

0%

|

|

Title4

|

0%

|

0%

|

0%

|

0%

|

|

Title5

|

0%

|

0%

|

0%

|

0%

|

| Header | Header | |

| Header | Q4 2023 | Q4 2023 |

|

Title1

|

0%

|

0%

|

|

Title2

|

0%

|

0%

|

|

Title3

|

0%

|

0%

|

|

Title4

|

0%

|

0%

|

|

Title5

|

0%

|

0%

|

| Country | Best Performing Style |

|

Title1

|

Value

|

|

Title2

|

Value

|

|

Title3

|

Value

|

|

Title4

|

Value

|

|

Title5

|

Value

|

|

Title6

|

Value

|

|

Title7

|

Value

|

|

Title8

|

Value

|

|

Title9

|

Value

|

|

Title10

|

Value

|

|

Title11

|

Value

|

|

Title12

|

Value

|

|

Title13

|

Value

|

Returns by style

| Q4 2023 | YTD | Q4 2023 |

YTD

|

||

|

Large Cap Value

|

0%

|

0%

|

Large Cap Value

|

0%

|

0%

|

|

Mid Cap Value

|

0%

|

0%

|

Mid Cap Value

|

0%

|

0%

|

|

Small Cap Value

|

0%

|

0%

|

Small Cap Value

|

0%

|

0%

|

| Q4 2023 | YTD | Q4 2023 |

YTD

|

||

|

Large Cap Value

|

0%

|

0%

|

Large Cap Growth

|

0%

|

0%

|

|

Mid Cap Value

|

0%

|

0%

|

Mid Cap Growth

|

0%

|

0%

|

|

Small Cap Value

|

0%

|

0%

|

Small Cap Growth

|

0%

|

0%

|

SECTOR Returns BY CAPITALIZATION

| U.S. Large Cap | U.S. Mid Cap | U.S. Small Cap | ||||

| Q4 2023 | YTD | Q4 2023 | YTD | Q4 2023 |

YTD

|

|

|

Basic Materials

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Consumer Goods

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Consumer Services

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Financials

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Health Care

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Industrials

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Oil & Gas

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Real Estate

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Technology

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Telecommunications

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Utilities

|

0%

|

0%

|

0%

|

0%

|

0%

|

0%

|

|

Source: Russell Investments & Industry Classification Benchmark

|

||||||

|

Large Cap: Russell Top 200 Index | Mid Cap: Russell Mid Cap Index | Small Cap: Russell 2000 Index

|

||||||

us valuations

| Quarter Ending 12/31/2023 | Quarter Ending 9/30/2023 | |||

| US Large Cap Equity | Value | Growth | Value | Growth |

|

Price/Earnings Ratio

|

0%

|

0%

|

0%

|

0%

|

|

IBES LT Growth (%)

|

0%

|

0%

|

0%

|

0%

|

|

1 Year Forward P/E Ratio

|

0%

|

0%

|

0%

|

0%

|

|

Negative Earnings (%)

|

0%

|

0%

|

0%

|

0%

|

| Quarter Ending 12/31/2023 | Quarter Ending 9/30/2023 | |||

| US Mid Cap Equity | Value | Growth | Value | Growth |

|

Price/Earnings Ratio

|

0%

|

0%

|

0%

|

0%

|

|

IBES LT Growth (%)

|

0%

|

0%

|

0%

|

0%

|

|

1 Year Forward P/E Ratio

|

0%

|

0%

|

0%

|

0%

|

|

Negative Earnings (%)

|

0%

|

0%

|

0%

|

0%

|

| Quarter Ending 12/31/2023 | Quarter Ending 9/30/2023 | |||

| US Small Cap Equity | Value | Growth | Value | Growth |

|

Price/Earnings Ratio

|

0%

|

0%

|

0%

|

0%

|

|

IBES LT Growth (%)

|

0%

|

0%

|

0%

|

0%

|

|

1 Year Forward P/E Ratio

|

0%

|

0%

|

0%

|

0%

|

|

Negative Earnings (%)

|

0%

|

0%

|

0%

|

0%

|

international valuations

| Quarter Ending 12/31/2023 | Quarter Ending 9/30/2023 | |||

| International Equity | Value | Growth | Value | Growth |

|

Price/Earnings Ratio

|

0%

|

0%

|

0%

|

0%

|

|

IBES LT Growth (%)

|

0%

|

0%

|

0%

|

0%

|

|

1 Year Forward P/E Ratio

|

0%

|

0%

|

0%

|

0%

|

|

Negative Earnings (%)

|

0%

|

0%

|

0%

|

0%

|

| Quarter Ending 12/31/2023 | Quarter Ending 9/30/2023 | |||

| Emerging Markets Equity | Value | Growth | Value | Growth |

|

Price/Earnings Ratio

|

0%

|

0%

|

0%

|

0%

|

|

IBES LT Growth (%)

|

0%

|

0%

|

0%

|

0%

|

|

1 Year Forward P/E Ratio

|

0%

|

0%

|

0%

|

0%

|

|

Negative Earnings (%)

|

0%

|

0%

|

0%

|

0%

|

|

Source: Russell Investments Total Equity Profile

|

||||

non-us developed / emerging cap & style

| Q4 2023 | YTD | Q4 2023 |

YTD

|

||

|

Large Cap Value

|

0%

|

0%

|

Large Cap Value

|

0%

|

0%

|

|

Mid Cap Value

|

0%

|

0%

|

Mid Cap Value

|

0%

|

0%

|

|

Small Cap Value

|

0%

|

0%

|

Small Cap Value

|

0%

|

0%

|

| Header | Header | |

| Header | Q4 2023 | Q4 2023 |

|

Title1

|

0%

|

0%

|

|

Title2

|

0%

|

0%

|

|

Title3

|

0%

|

0%

|

|

Title4

|

0%

|

0%

|

|

Title5

|

0%

|

0%

|

| Country | Best Performing Style |

|

Australia

|

Value

|

|

Brazil

|

Value

|

|

Canada

|

Value

|

|

China

|

Value

|

|

France

|

Value

|

|

Germany

|

Value

|

|

Hong Kong

|

Value

|

|

Indonesia

|

Value

|

|

Italy

|

Value

|

|

Japan

|

Value

|

|

Mexico

|

Value

|

|

Singapore

|

Value

|

|

Spain

|

Value

|

|

Thailand

|

Value

|

SECTOR Returns BY CAPITALIZATION:

| U.S. Large Cap | U.S. Mid Cap | U.S. Small Cap | ||||

| Q4 2023 | YTD | Q4 2023 | YTD | Q4 2023 |

YTD

|

|

|

Basic Materials

|

9.8

|

16.1

|

10.4

|

10.3

|

14.3

|

16.0

|

|

Consumer Goods

|

3.8

|

-3.1

|

3.4

|

-0.6

|

11.6

|

12.1

|

|

Consumer Services

|

12.9

|

42.6

|

14.7

|

23.7

|

15.3

|

25.8

|

|

Financials

|

14.5

|

16.5

|

15.1

|

13.2

|

23.5

|

12.2

|

|

Health Care

|

5.3

|

2.6

|

10.6

|

2.5

|

16.8

|

8.6

|

|

Industrials

|

13.1

|

15.9

|

14.6

|

27.8

|

13.9

|

29.2

|

|

Oil & Gas

|

-9.0

|

-3.9

|

-0.4

|

1.2

|

-5.9

|

8.4

|

|

Real Estate

|

21.7

|

12.4

|

16.8

|

11.7

|

17.3

|

14.3

|

|

Technology

|

16.5 | 70.8 | 15.6 | 40.7 | 13.7 | 27.6 |

|

Telecommunications

|

6.2 | 12.8 | 8.0 | 8.5 | 8.1 | -1.3 |

|

Utilities

|

9.0 | -9.1 | 10.1 | -0.5 | 7.0 | -7.3 |

|

Source: Russell Investments & Industry Classification Benchmark

|

||||||

|

Large Cap: Russell Top 200 Index | Mid Cap: Russell Mid Cap Index | Small Cap: Russell 2000 Index

|

||||||

GLOBAL EQUITY PERFORMANCE

row-spacer

row-spacer

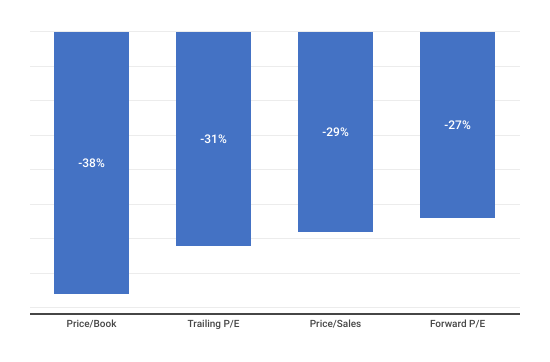

US VALUATIONS

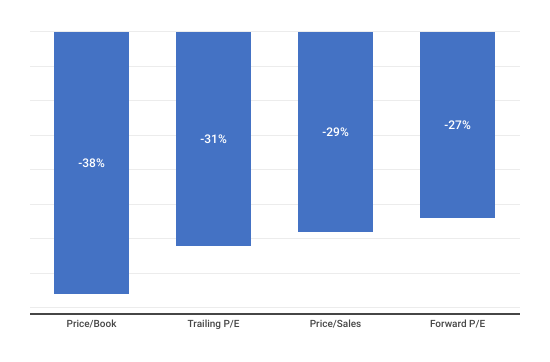

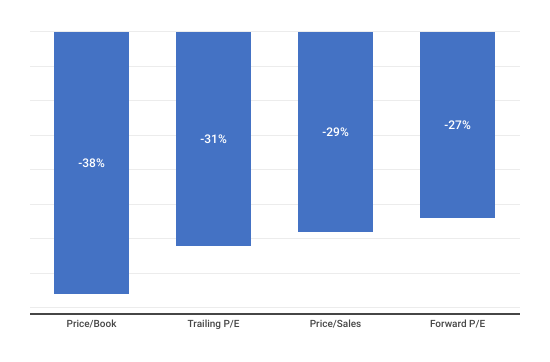

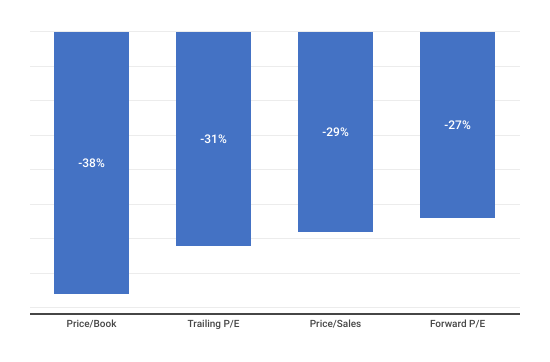

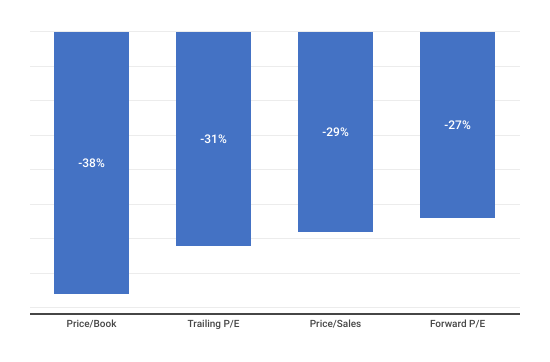

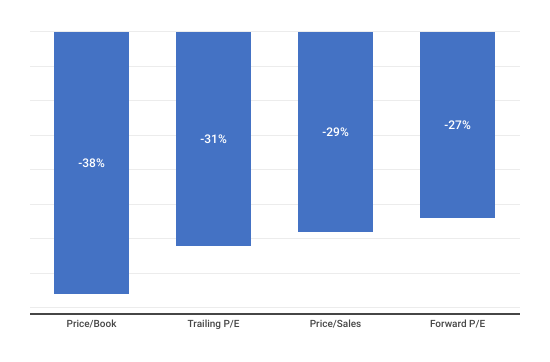

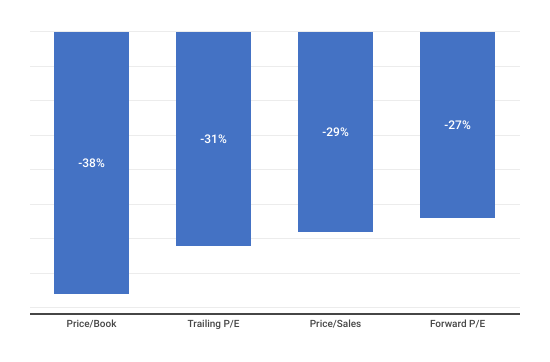

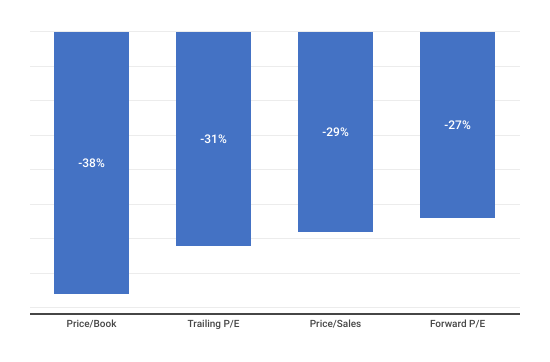

Price multiples expanded across the domestic equity market in Q4. Multiple expansion was greatest among small-cap value equities; however, all domestic equity size/style pairings experienced a double-digit percentage increase in forward P/E. On a normalized basis, the S&P 500 Index remains expensively priced, trading at a cyclically adjusted P/E (CAPE) more than two standard deviations above its long-term average.

Earnings growth estimates for US equities declined over the quarter, with Q4 earnings now expected to grow 1.3% year over year (down from an estimated 8.0% at the beginning of the quarter). Overall, five of the eleven sectors are projected to increase earnings, led by communication services (+42%), utilities (+33%), consumer discretionary (+23%), and tech (+16%). Conversely, energy (-29%), materials (-20%), and healthcare (-20%) are expected to post the most significant declines. Looking ahead, analysts’ estimates currently predict earnings and revenue growth of 11.8% and 5.5%, respectively, for CY 2024.

| Quarter Ending 12/31/2023 | Quarter Ending 9/30/2023 | |||

| US Large Cap Equity | Value | Growth | Value | Growth |

|

Price/Earnings Ratio

|

20.3

|

36.4

|

18.3 | 34.4 |

|

IBES LT Growth (%)

|

8.0 | 13.8 | 6.8 | 13.7 |

|

1 Year Forward P/E Ratio

|

15.4 | 27.1 | 14.0 | 24.3 |

|

Negative Earnings (%)

|

7.9 | 2.7 | 7.3 | 4.1 |

| Quarter Ending 12/31/2023 | Quarter Ending 9/30/2023 | |||

| US Mid Cap Equity | Value | Growth | Value | Growth |

|

Price/Earnings Ratio

|

23.4 | 39.1 | 20.7 | 40.1 |

|

IBES LT Growth (%)

|

7.6 | 15.8 | 8.5 | 16.7 |

|

1 Year Forward P/E Ratio

|

15.6 | 24.7 | 13.7 | 21.6 |

|

Negative Earnings (%)

|

11.5 | 16.7 | 11.3 | 19.0 |

| Quarter Ending 12/31/2023 | Quarter Ending 9/30/2023 | |||

| US Small Cap Equity | Value | Growth | Value | Growth |

|

Price/Earnings Ratio

|

23.8 | 15.7 | 18.1 | 74.1 |

|

IBES LT Growth (%)

|

7.9 | 14.3 | 8.6 | 15.1 |

|

1 Year Forward P/E Ratio

|

12.3 | 18.6 | 10.4 | 16.6 |

|

Negative Earnings (%)

|

23.9 | 30.8 | 23.6 | 30.7 |

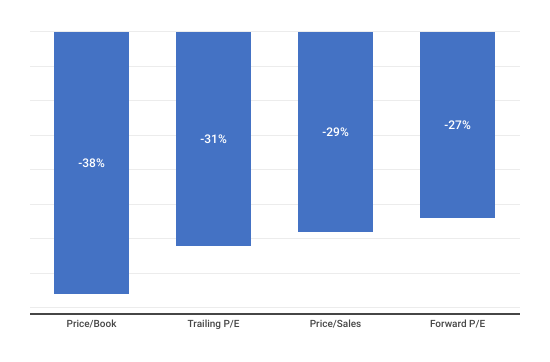

INTERNATIONAL VALUATIONS

Both non-US developed growth- and value-style equities registered multiple expansion, albeit at a more muted pace than domestic equities. On both an absolute and relative basis, international equities continue to trade at a discount relative to historical averages (as compared to US equities). Emerging-market valuations also trended higher in Q4, although they remain cheap on both an absolute and relative basis.

Europe is expected to increase earnings by 4% in 2023 and 5% in 2024, while Japan is expected to deliver 7% and 9% increases, respectively. The broader emerging markets are expected to see earnings contract by 11% in 2023 before growing by 18% in 2024.

| Quarter Ending 12/31/2023 | Quarter Ending 9/30/2023 | |||

| International Equity | Value | Growth | Value | Growth |

|

Price/Earnings Ratio

|

10.8 | 23.7 | 10.6 | 22.4 |

|

IBES LT Growth (%)

|

5.5 | 12.5 | 5.6 | 12.9 |

|

1 Year Forward P/E Ratio

|

9.8 | 20.5 | 9.6 | 19.4 |

|

Negative Earnings (%)

|

6.7 | 3.2 | 4.7 | 3.2 |

| Emerging Markets Equity | Quarter Ending 12/31/2023 | Quarter Ending 9/30/2023 |

|

Price/Earnings Ratio

|

15.7

|

15.0

|

|

IBES LT Growth (%)

|

12.3

|

11.4

|

|

1 Year Forward P/E Ratio

|

13.3

|

12.8

|

|

Negative Earnings (%)

|

5.1

|

5.0

|

|

Source: Russell Investments Total Equity Profile

|

||

non-us developed / emerging cap & style: MSCI AC WORLD EX - US INDICES

(SOURCE: MSCI - DATA SOURCED 'AS IS')

| Q4 2023 | YTD | Q4 2023 |

YTD

|

||

|

Large Cap Value

|

8.2%

|

17.5%

|

Large Cap Growth

|

11.3%

|

13.7%

|

|

Mid Cap Value

|

9.2%

|

16.4%

|

Mid Cap Growth

|

10.4%

|

15.5%

|

|

Small Cap Value

|

10.1%

|

17.2%

|

Small Cap Growth

|

10.2%

|

14.1%

|

| Country | Best Performing Style |

|

Australia

|

Value

|

|

Brazil

|

Growth

|

|

Canada

|

Value

|

|

China

|

Value

|

|

France

|

Value

|

|

Germany

|

Value

|

|

Hong Kong

|

Value

|

|

Indonesia

|

Value

|

|

Italy

|

Value

|

|

Japan

|

Value

|

|

Mexico

|

Value

|

|

Singapore

|

Value

|

|

Spain

|

Value

|

|

Thailand

|

Growth

|

|

United Kingdom

|

Value

|

US SPREAD PRODUCTS

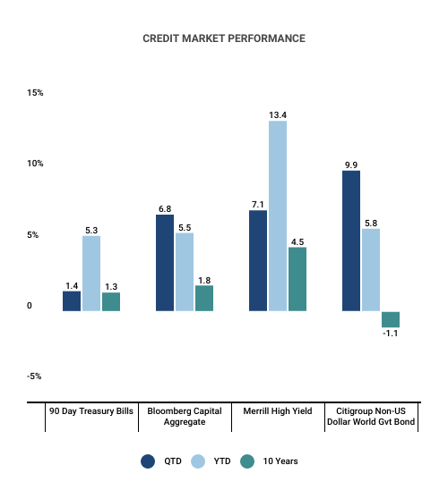

The investment-grade corporate bond market returned 8.5% for both the quarter and full year. For the quarter, the return drivers were rates (+), spreads (+), and coupons (+). The falling interest-rate environment was the primary driver of this market’s return; the duration for this market is approximately 7.1 years. This market’s option-adjusted spread (OAS) tightened by 22 bps to end the quarter at 99 bps, which is approximately 20 bps below the ten-year median spread. Performance by credit quality favored lower-quality issues: Baa-rated corporates, 8.8%; A-rated corporates, 8.1%; and Aa-rated corporates, 6.2%. This market’s issuance totaled approximately $220 billion for the quarter, a marginal increase from the corresponding period in 2022; issuance for CY 2023 was approximately $1.25 trillion, mostly unchanged from CY 2022.

The high-yield corporate-bond market returned 7.2% for the quarter and 13.4% for the full year. For the quarter, the return drivers were rates (+), spreads (+), and coupons (+). Falling interest rates and tighter spreads were the primary drivers of this market’s return. This market’s OAS tightened by 71 bps to end the quarter at 323 bps, which is approximately 70 bps below the ten-year median spread. A decrease in yields across the Treasury curve helped higher-quality credits outperform—in general, higher-quality credits have relatively longer-maturity debt: Ba-rated corporates, 7.4%; B-rated corporates, 7.0%; and Caa-rated corporates, 6.9%. This market’s issuance totaled approximately $47 billion for the quarter, an increase of nearly 200% from the corresponding period in 2022; issuance in CY 2023 was approximately $184 billion, more than 60% greater than that in CY 2022.

hello world

GDP

During Q3 2023, real GDP rose at an annual rate of 4.9% followed by a 2.1% increase in Q2 2023. The increase was driven by consumer spending and inventory investment; imports also increased. Overall, 14 of 22 industry groups contributed to real GDP growth in the third quarter; the value added from private goods-producing industries was particularly strong at 10.2%.

Retail Sales

Total retail and food sales increased 0.3% and 4.1% month-to-date and year-to-date ending November 2023, respectively. Total sales from September through November 2023 were up 3.4% compared to the same period one year ago; the percentage change over the same period was up 0.4%. Significant contributors include non-store retailers and food services and drinking places.

Unemployment

A total of 494,000 jobs were created in the fourth quarter of 2023, which did not outpace the previous quarter’s gains of 710,000. The US economy added 216,000 jobs in November, which is below the twelve-month average monthly gain of 225,000. December’s notable job gains occurred within the following industries: government (+52,000), health care (+38,000), social assistance (+21,000), and construction (+17,000).

The unemployment rate remains unchanged from the previous quarter’s average at 3.7%. The number of unemployed persons (6.3 million) experienced minimal net movement as well. The labor force participation rate decreased by 0.3% in December (62.5%).

VIX

During Q2 2023, real GDP rose at an annual rate of 2.1%, following a 2.2% increase in Q1. The increase was driven by state and local government spending, non-residential fixed investment, and consumer spending, partially offset by a decrease in exports; imports also decreased. Relative to Q1, the second quarter experienced a slowdown in consumer and federal government spending alongside the decline in exports, which drove the Q2 deceleration of real GDP.

Charts

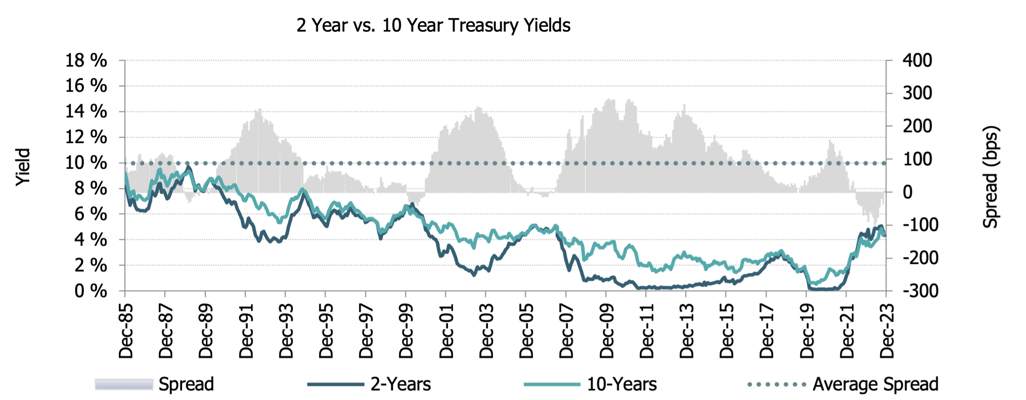

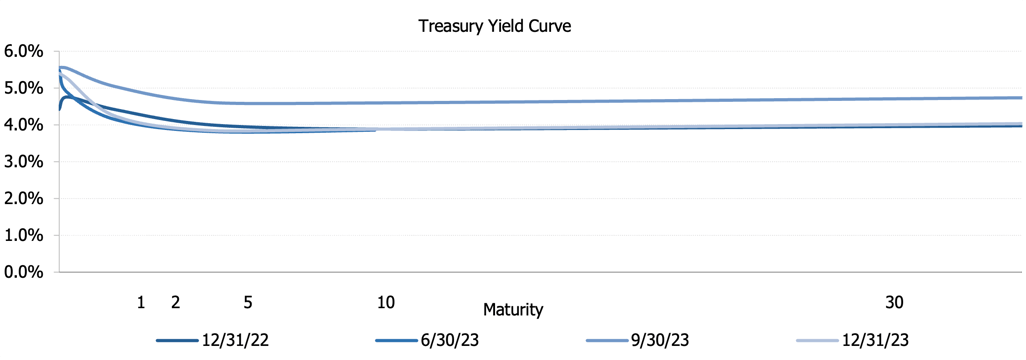

YIELD CURVE

The US Treasury yield curve fell sharply during the quarter. Yields decreased by approximately 65-80 bps for all points on the curve from the one-year bill to the 30-year bond. Notably, the two-year note’s yield fell 80 bps to 4.23%, while the ten-year note’s yield fell 71 bps to 3.88%. The two- to ten-year spread increased by 9 bps (to -35 bps); despite the appearance of an economic soft landing, the spread is still 1.3 standard deviations below its historical mean (88 bps). Four primary factors likely underpin the sharp fall in yields: the US Treasury tilted issuance toward bills (to alleviate coupon-supply concerns), core inflation continued to moderate toward 2%, the Fed projected a meaningful reduction in interest rates by the end of 2024, and economic growth and employment appeared to cool to less-inflationary levels.

At the end of 2023, the federal-funds futures market predicted a target rate of 3.77% by the end of 2024, approximately 80 bps below that expected by Fed officials.

Love these and want more?

Enter your email address below and we will let you know when we add new resources.